Covid-19 Pandemic Unable to Impact the Housing Market

The other day as I waited on the drive-thru lane to pay for my order I noticed in front of me this car and the person inside pointing at my car as this person was paying for his order. I drove up to pay and to my surprise the person that had been pointing at me had also paid for my order. I asked the employee why that person paid for my food? He said, “the man told me he wanted to surprise and bless someone. Well that was definitely a surprise and totally unexpected for me. That’s the same reaction many home owners selling their homes and investors feel like right now. That what seemed to be worst than the Great Recession turned out to be the total opposite.

Before you take my word, look at these facts…

Expected Market Time Better Compared to Last Year

Expected Market Time is the amount of time between hammering in the FOR-SALE sign to opening escrow. Around mid-April the Expected Market Time was around 120 days, a buyer’s market. From then it has dropped 39% at 74 days, in favor to the sellers, something totally unexpected. Even last year the Expected Market Time was at 85 days, slower than today.

What has led to this massive drop from mid-April? Homeowners know they are sitting on a mountain of equity and because of record breaking low mortgage rates they are refinancing or selling to buy more property at better rates.

Home Affordability Has Improved – Mortgage Rates at 3.15%

Home affordability has improved dramatically due to record low rates and buyers want to take advantage of this incredible opportunity. From last week the mortgage rate has dropped again to an all-time low.

ABC News reported:

Mortgage buyer Freddie Mac reported Thursday that the average rate on the 30-year loan tumbled to 3.15% from 3.24% last week. It was the lowest level since since Freddie started tracking rates in 1971. A year ago, the rate stood at 3.99%.

ABC News

Prior to the Great Recession, mortgage rates were at 6.35%. A $700,000 mortgage payment at 3.15% is $3,008 per month compared to $4,356 per month Prior to the Great Recession in 2007. That is a savings of $1,348 per month, or $16,176 per year.

Demand Has Surged 23% in the Last 2 Weeks in Orange County

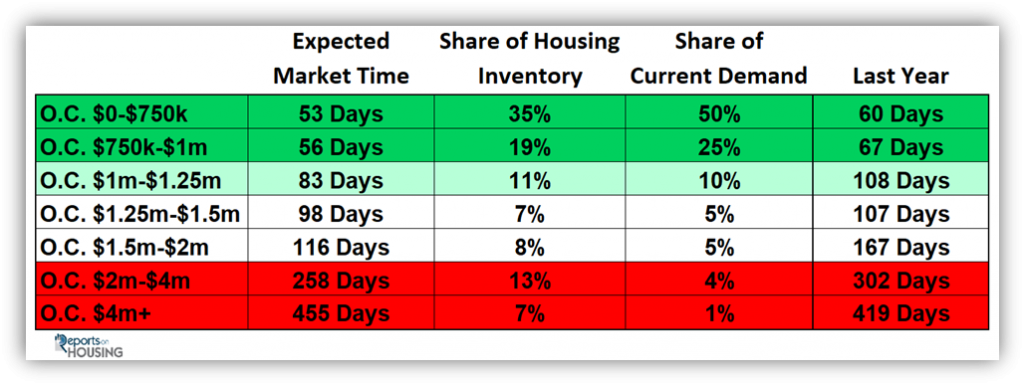

Let’s take a look at some statistics from Reports On Housing website about the increase on demand for the Orange County area in the past few weeks.

Demand, the number of new pending sales over the prior month, increased from 1,622 to 2,035, an additional 413 pending sales, up an incredible 23% in just two weeks. In the past 4-weeks, demand has added 863 pending sales, a 74% rise. With mortgage rates dropping to 3.15%, an all-time record low, more buyers are entering the market, eager to take advantage of extremely favorable home affordability. Expect demand to continue to increase as more inventory comes on the market.

The Orange County Housing Report

Last year, there were 611 more pending sales than today, 23% extra. In mid-April, at the low point of the COVID-19 pandemic, demand was off by 60% year over year. The year over year gap is narrowing as the market continues to heat up.

In the past two-weeks the Expected Market Time dropped from 90 to 74 days, a slight Seller’s Market (between 60 and 90 days), where sellers get to call more of the shots during the negotiating process, yet home values are not changing much. Last year the Expected Market Time was at 85 days, slower than today.

We have seen three totally unexpected reasons to be surprised of today’s real estate market. First, the Expected Market Time is getting better; second, mortgage rates at record low, 3.15%; and lastly, demand is sky rocking in the Orange County area. These three facts gives us the confidence why we should sell and invest in real estate. We have gathered information from reliable sources proving that the market is better than ever.

If you are unsure if selling your house is the right decision. You might want to rethink, you can rest assured that selling is a wise decision because buyers are out there taking advantage of low mortgage rates. Partner with the right investor that will guarantee you a good return on your investment. Contact us through this form http://xoticproperties.com/sell-your-home/, we will contact you as soon as possible.