How You Can Buy A Home

Are you thinking about buying a home? Do you have the budget to fulfill this long-cherished dream? Many of us want to buy a home, but obstacles such as limited earning, lack of savings, and additional expenses make it nearly impossible to plan the next step. In this article, we will discuss some proven ways to accomplish this goal, even with an inflexible budget.

First, familiarize yourself with your current financial condition and explore the possibility of collecting money from financial organizations and non-profit organizations. Also, remember to check your credit score! If you find it difficult to buy a home on your own, you can consider co-ownership with family or a close friend. If you have a strong desire to buy a home yourself, there are also other options that can help fulfill your dream and give you the chance to relax in your own home.

We will start with your credit score. There is no denying that you need a good credit score if you want to be financed by profit or non-profit organizations. Even so, that does not mean you must have an excellent credit score to qualify for a loan. It is important to know the minimum credit scores necessary to qualify for certain loans. Doing so will give you confidence on whether or not you are in a good position to buy a new home. Let’s make it a bit easier for you with more details.

MINIMUM CREDIT SCORES FOR FHA

As you know, a good credit score is crucial if you want to obtain financing. It is worth mentioning that the minimum score may be below your expectation. If you are buying a home with another person, then the credit score of both members will be taken into account when applying for a loan. Therefore, it is ideal if your partner has a satisfactory credit score. It does not necessarily have to be an extraordinary credit score but it must meet the minimum.

The minimum credit score necessary will vary depending on the type of the loan, lender, and your location. For the Federal Housing Loan, the minimum credit score is 500. This may sound a bit surprising but yes, you can qualify for a housing loan with this minimum credit score.

If your credit score is somewhere between 500 and 579, the down payment will be at least ten percent. However, if your credit score is above 580, the down payment will be less. You can qualify for a FHA loan with 3.5% or even less down payment. That means you can get a loan for your home with around four percent down payment when you have a credit score of 580 or higher. If you do not meet this minimum, you can follow some methods to improve your credit score so you can qualify for a loan with the lowest possible down payment.

LEVERAGE YOUR CREDIT UNIONS

Now, you are aware of the minimum credit score necessary to qualify for an FHA loan. The next step is to look for more affordable and suitable options. When you are planning to buy a home without a flexible budget, you should check all your financing options and compare their interest rates to find the best deal.

Make sure you do proper research on different credit unions! Credit unions have lower fees when compared to banks or similar lenders. This is because credit unions are nonprofit organizations while banks are profit institutions.

There are many benefits to choosing credit unions over banks. First of all, you can expect an easy approval. You are also more likely to be approved for a loan even if you have a poor credit score. Generally, credit unions require smaller down payments. Additionally, you can expect excellent customer service, better interest rates, and lower fees. There are many possible options and you should research the available credit unions to find one with a good reputation, as well as low interest rates and fees.

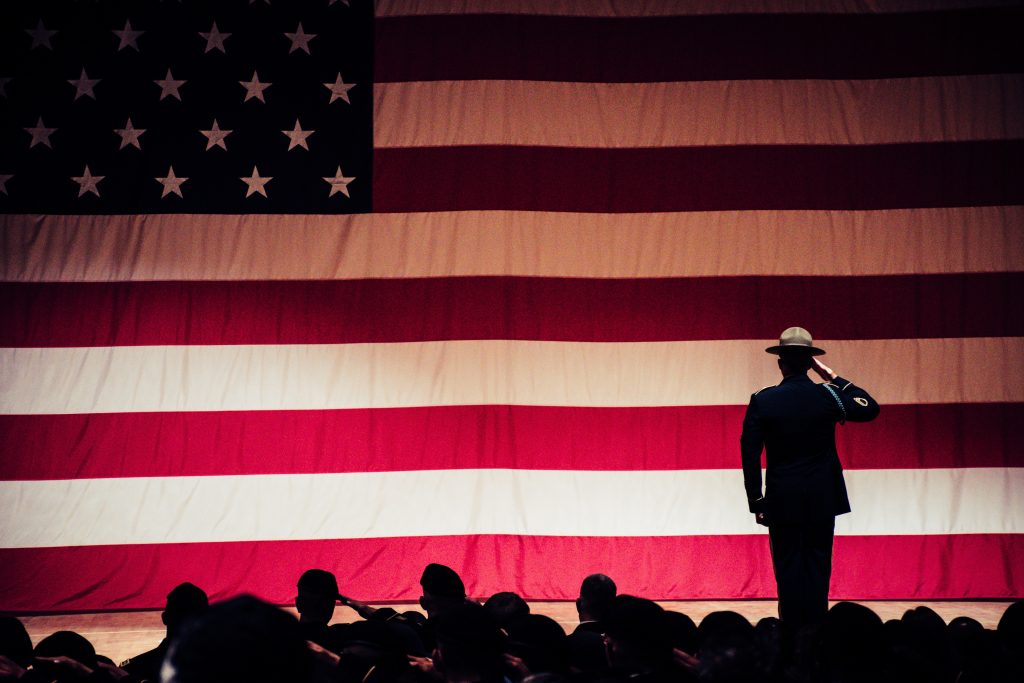

MILITARY BENEFITS

If you are serving in the military, you can consider buying your dream home when you are on active duty. You can apply for the VA loan program, which offers key benefits such as no down payment, lower interest rates, flexible credit score, no mortgage insurance, and a limit on the closing costs. These significant benefits can inspire any to buy a home while serving in the military.

With the recent changes in VA home loans passed on January 1, 2020, you can expect even more benefits. Now, the same funding fees apply for the Guard, Active Duty, and Reserve.

BUY YOUR HOME WITH SOMEONE ELSE

When it is not possible to buy a home on your own, you can think about co-owning. Co-ownership can allow you to buy your dream home while staying within your budget. However, you should choose someone trustworthy such as a sibling, partner, or a reliable friend. Make sure you check their credit to ensure that you both meet the minimum credit score.

There are many benefits to co-owning a home. When there are two persons signing a form, you can expect easier approval, lower monthly expenses, and tax-deductibles. The longer both of you stay together, the more equity you will gain. Honestly speaking, one of you will choose a separate way one day. However, you can choose to leave with cash in your pocket, a benefit you don’t get from renting. Both of you can make money from the sale. Afterwards, you can use this money for the down payment of your new home.

WRAPPING UP

Now, you might find yourself a bit closer to obtaining your dream home. As mentioned, there are many ways to buy a home with a limited budget. You just need to explore all your possible options and act smart if you decide to co-own a home with a partner.