Supply and Demand

Like many other investors, I’ve been watching the impacts of COVID-19 on the real estate market like a hawk. Now that everyone is online, we’re quickly adapting as a society to offering webinars – almost to the degree of being overwhelmed by the all of the options. I am not an economics major but I do find it interesting looking at today’s market through the lens of those who make their living at it. One of my favorite people in this field is Steven Thomas. He does a Housing Debrief every Tuesday & Friday at 3pm PT (we’re up to episode 9 already, wow!) that is not only very practical and informative, but is also positive (just my kind of thing). Yes there’s a lot of “bad” happening in the world now, especially in the economy, but there are still opportunities for those who are open to them. Be sure to sign up for his newsletter – and PLEASE mention me (melissa@xoticproperties.com) as your referrer.

Supply and Demand

Up until COVID, we were in a seller’s market – all over the US but particularly here in Orange County. This simply means that there were more buyers looking for homes than there were people trying to sell their homes. This typically drives up prices as you would imagine. One would think that COVID would’ve swung us even further to this side but what we’re actually seeing is a balancing between supply and demand (a Balanced Market). Home sales have slowed for sure but they have not stopped. On the opposite side, there are still buyers, albeit fewer. Even in the real estate investing industry many investors are deciding to wait it out. NOT the case for Xotic Properties, as we’ve ramped up our efforts to invest! If you know of anyone selling, please let us know. But back to the topic at hand…why do I say we’re in a Balanced Market (one that doesn’t favor buyers OR sellers)? Let’s take a look at some of the data (courtesy of the Orange County Housing Report, www.reportsonhousing.com).

www.reportsonhousing.com

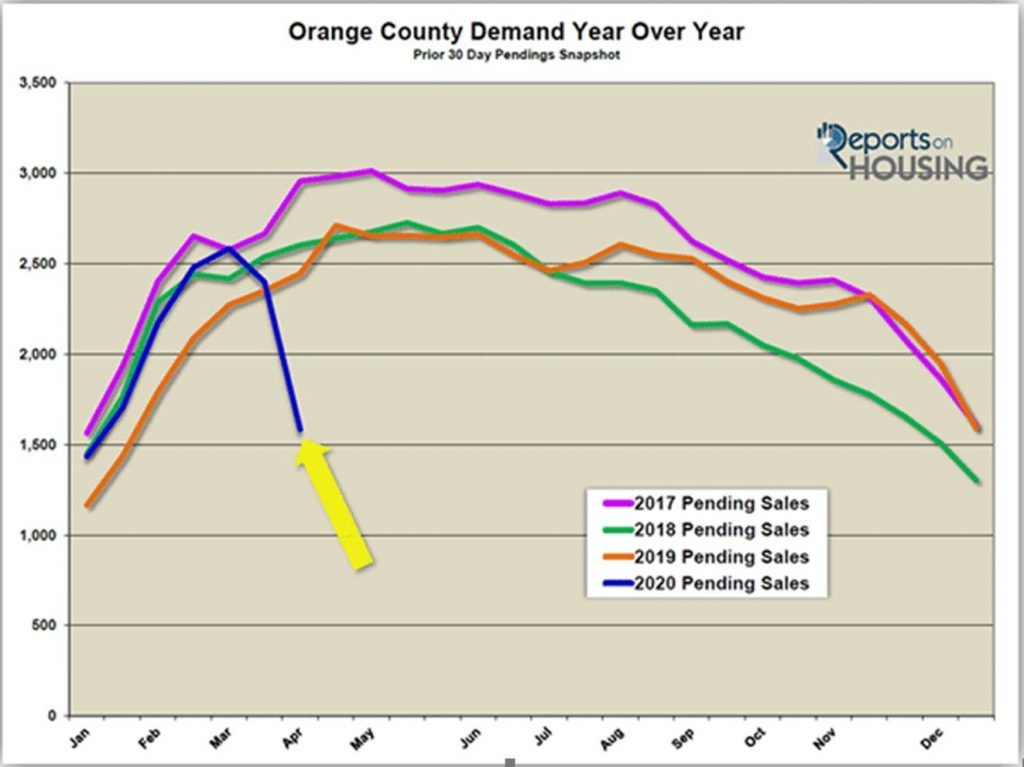

Demand has plunged 34% in the past two weeks. If you were to look at this alone, you might conclude that it’s not a good time to sell. But let’s take a look at Supply next.

www.reportsonhousing.com

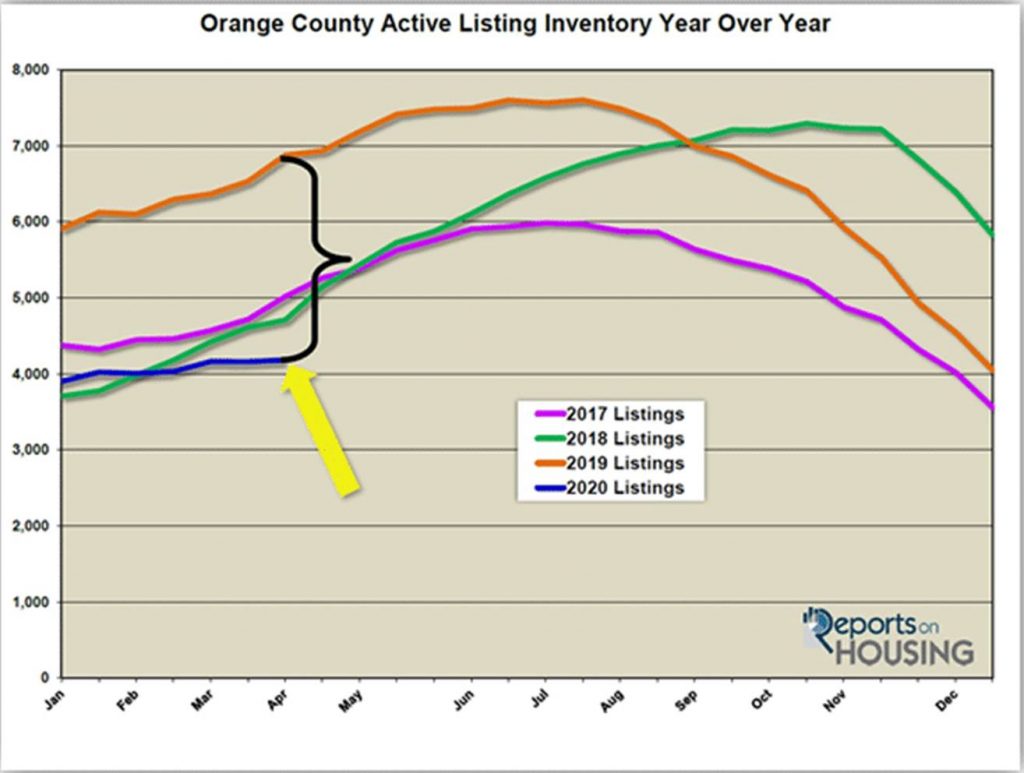

Active listings of home sales (i.e., Supply) is also down, by a staggering 39% compared to March of last year. Ordinarily, Spring is the time when the housing market picks up and sellers start to put their homes on the market. Once again, if you were to look at Supply on its own, you might conclude it’s the wrong time to buy. Instead, with both of these now matched, we have a Balanced Market.

Why would you want to buy or sell in this current climate?

As I talk with realtors all across the country, the pandemic has definitely caused a dramatic decrease in home showings, but it’s also caused more QUALITY showings. People are now fully vetted by the time they’re “accepted” to view a home. They’ve got their finances lined up, they’ve checked out homes online and via pictures, they’ve asked questions, and they’ve prepared a short list of homes to view. Imagine that, everyone in the industry is being forced to do more planning and due diligence beforehand. I actually hope that this practice continues long after the pandemic is behind us. It’s a fantastic time to sell your home! It’s a fantastic time to be in the market to buy a home!

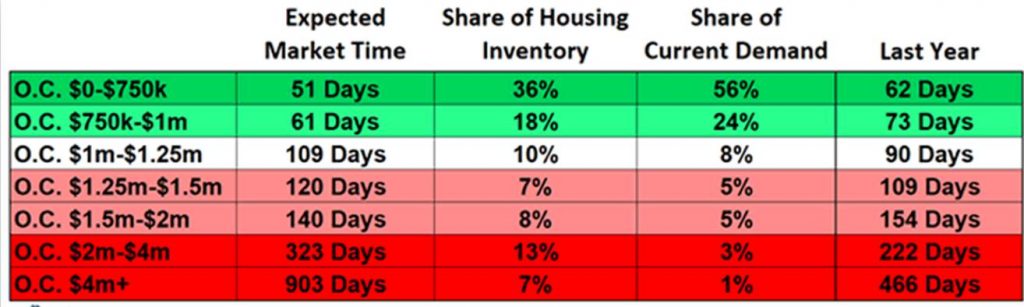

Just be prepared that it may take a little longer. The logistics are more difficult to show your home (it changes daily so rely on your realtor if you’ve listed, or call me if you need help), retail buyers have more hoops to go through than before so they may be slower to actually make offers, and escrow could take a little longer. But this doesn’t mean that you won’t get offers; in fact, I’m still seeing multiple offers happening on homes. If you’re in the less than $1MM range (here in SoCal) it’s actually an optimal time to sell. Here’s a snapshot as of April 6th:

As you’d imagine, the Luxury market has had the largest impact. Not only are there less luxury homes available but they are staying on the market substantially longer than this time last year. I also found it interesting that the amount for what’s considered luxury has decreased. In South Orange County, for instance, Luxury has decreased to $1.25M. This is a factor of the mortgage industry and what they now classify as a Jumbo loan; it’s not actually a definition of “luxury.” Banks have become more restrictive on their lending practices in general, making it tougher for buyers to qualify (especially true in the Jumbo loan space). Just be patient, but it’s not necessary to “wait it out.”

I’m actually excited as I watch what’s happening in the market. While other investors are scaling back, Xotic Properties is lunging forward. It’s critical to exercise caution when purchasing (we’re regularly adjusting our formulas to account for the changing market – by way of longer hold times, market adjustments, etc.) but this is not the time to stop altogether. Those of us providing all cash offers still have the ability to bypass a lot of the red tape, which is especially helpful in today’s economy.

It’s hard to predict what the future holds but we’ll continue to watch, learn, adjust, and respond. I wish our investor friends and sellers much success! Would love to hear your feedback and additional insights below.